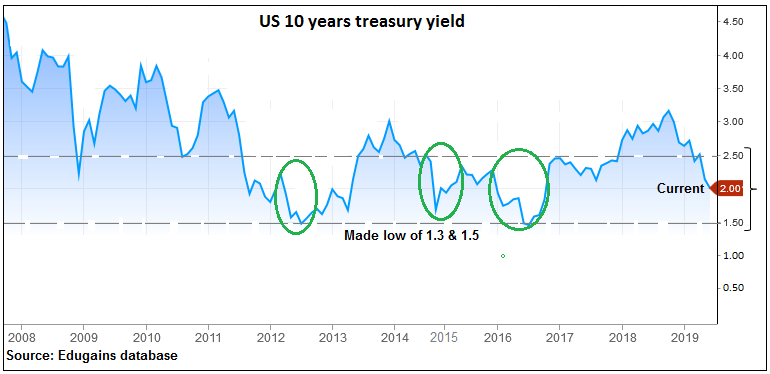

.In expectation of rate cut by US Fed, 10 year US Bond yield is already down from its high of 2.8% (Oct-18) to now 2.0. In last 2 years, US Fed increased the rate 7 times from 0.75 to 2.5 resulting in US ten year yield rising from low of 1.8% to 2.8%.

.Given that US economy is showing signs of slow down and country has elections in Nov-20, politicians may do every thing to prop up economy and ensure interest rates remain low. As a result, we estimate a gradual interest rate reduction of about 0.75 to 1% over next 12-15 months. This could mean that US Ten year yield could see a low of 1.6%-1.8% over next few months.

Softer yields in US, Europe and Japan would mean ease in global liquidity and this could add to sentiments of Emerging markets equities, currencies and bonds.

.

In past, a drop in US yields from 2 to about 1.5% (period circled green in below chart), did not mean gains in INR (as gains were already seen in expectations). Any movement in INR would be a function of many other factors. For now, current account situation looks under control as crude is not seeing any major spurt and we expect healthy inflows in capital account.

.

Going ahead, we foresee that INR may not see any major weakness and any spike towards 70-70.50 could be used to hedge long term exports and capture healthy forward premiums of Rs 3-3.25 per USD.

.

.

*Disclaimer: Best efforts have been made to present the analysis and data as correctly as possible. However, it is prone to errors and therefore clients are expected to do their own analysis, independent of what is shared above, before taking decisions. This is neither a solicitation nor a recommendation to Buy/Sell any currency. No representation is being made that any suggestion being made above will necessarily result into profits and principals/employees/